Identify All Your Critical Data

Discover and inventory all your critical, sensitive, personal, and high-risk data to identify and ensure complete and comprehensive risk data reporting.

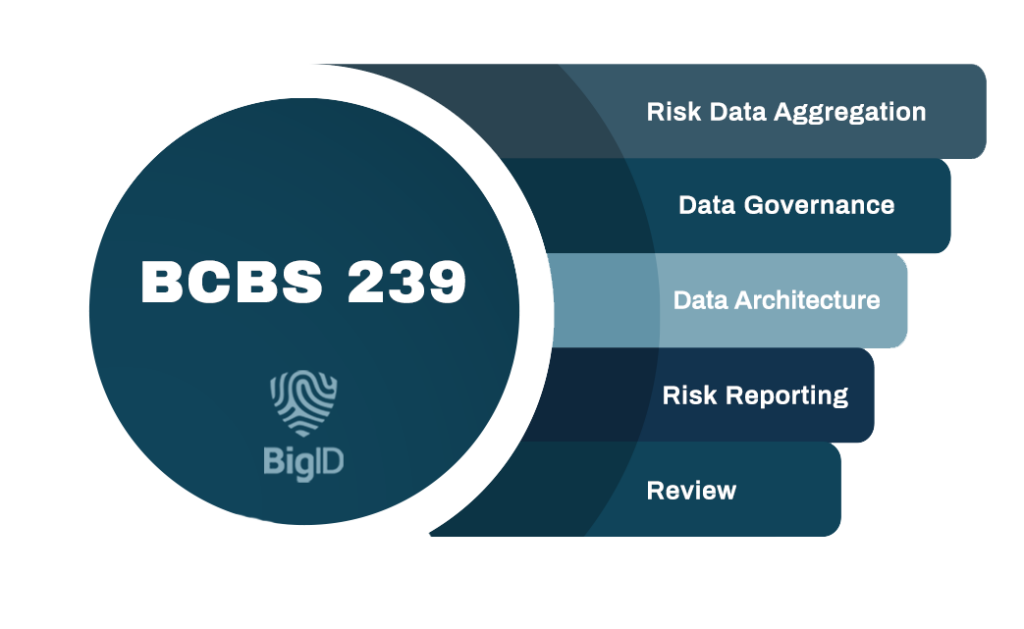

BCBS 239 is the Basel Committee on Banking Supervision’s standard number 239 (BCBS 239). Originally developed as a response to the 2007-08 financial crisis, it aims to enhance risk management and decision-making at banks to improve financial stability worldwide.

The standard addresses the “too big to fail” interdependence of Global Systemically Important Banks (G-SIBs) and Domestic Systemically Important Banks (D-SIBs), encouraging their risk data aggregation capabilities and internal risk reporting practices.

Key challenges and components of BCBS 239 require financial institutions to strengthen their ability to identify, manage, and monitor their high-risk data; establish actionable governance and data management practices; and reduce risk.

Banks need to establish strong governance, data architecture, and IT infrastructure arrangements.

Banks must be able to create accurate and reliable risk data that is complete, up-to-date, and adaptable to changing needs and requests.

Risk management reports must accurately reflect risk, be reconciled and validated, have a comprehensive scope, and communicate clearly.

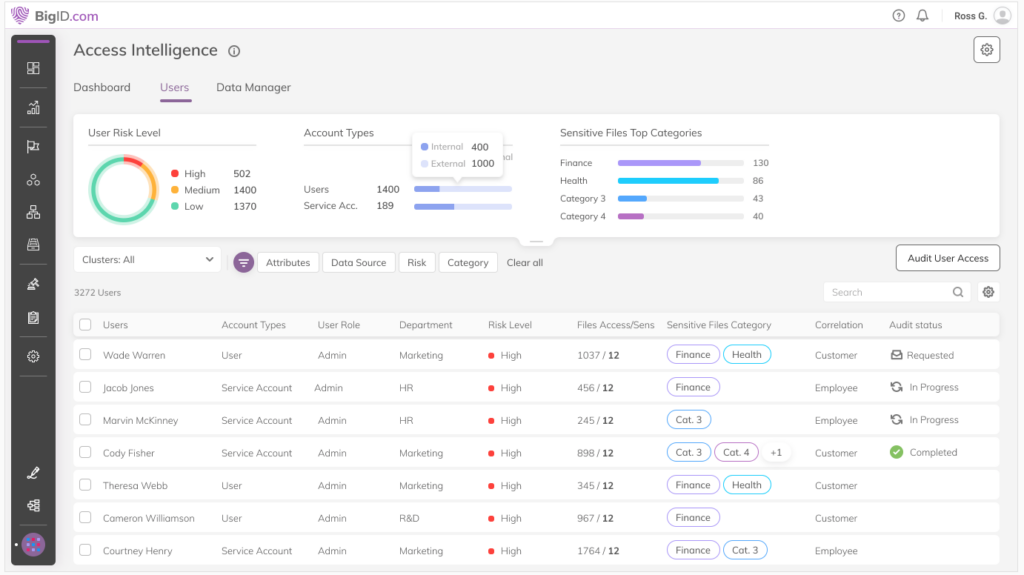

Discover and inventory all your critical, sensitive, personal, and high-risk data to identify and ensure complete and comprehensive risk data reporting.

Complete regulatory compliance risk data across all divisions of the enterprise — through every stage of mergers & acquisitions.

Reduce fragmentation across the data landscape, strengthening privacy, security, and governance programs.

Supervisors must periodically review and evaluate the bank’s compliance, take action to remediate when necessary, and cooperate with supervisors in other jurisdictions.

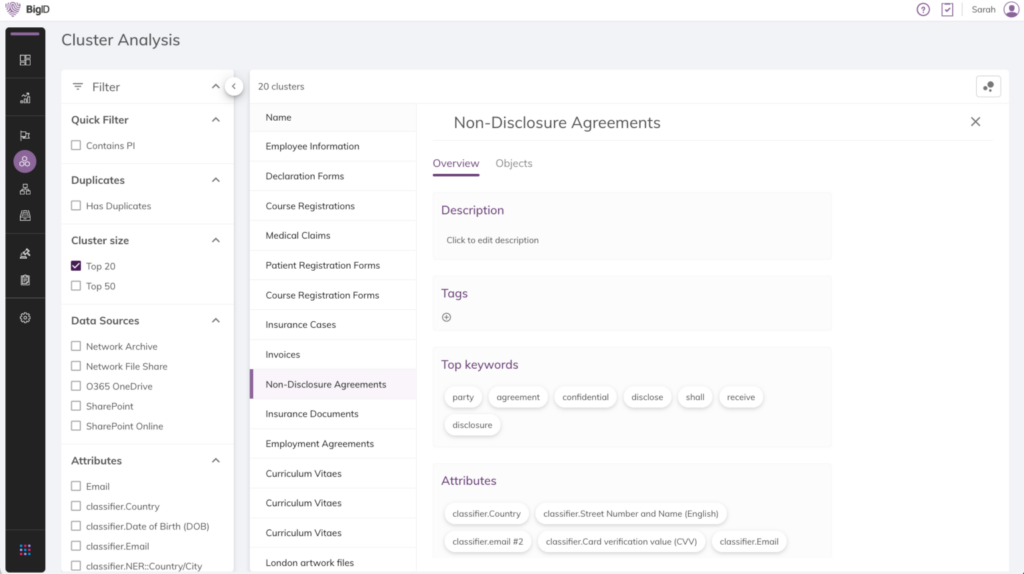

Discover all sensitive and regulated data that falls under BCBS 239, wherever it’s stored

Take an ML-based approach to automatically classify and tag high risk data that falls under BCBS

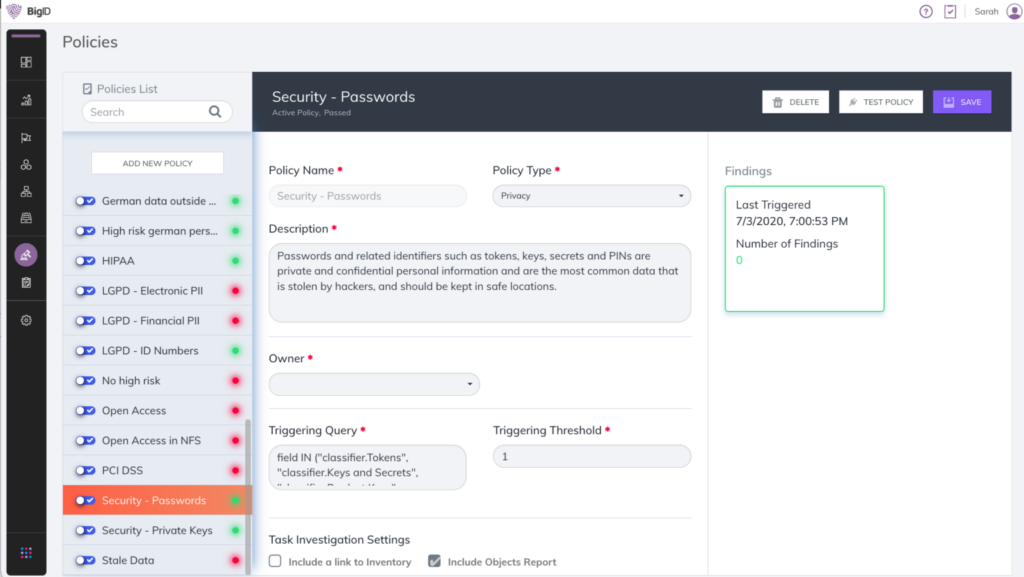

Remediate sensitive and regulated BCBS 239 data and manage high risk data with remediation workflows and audit trails.

Leverage out of the box and custom data retention rules to manage high risk data.

Get a custom demo with our data experts in privacy, protection, and perspective – and see BigID in action.