Data Remediation App

Enable remediation of high-risk, sensitive, and regulated data.

PCI DSS comprises a minimum set of security requirements for organizations as guidance to protect and secure sensitive payment-related data across their environment. It contains detailed guidelines and best practices to prepare for, execute, and measure the performance of PCI DSS assessments and subsequently help meet compliance mandates.

BigID helps organizations meet PCI DSS requirements using a modern Data Intelligence Platform that combines sensitive data discovery, next-gen classification, and risk management. With BigID, organizations can:

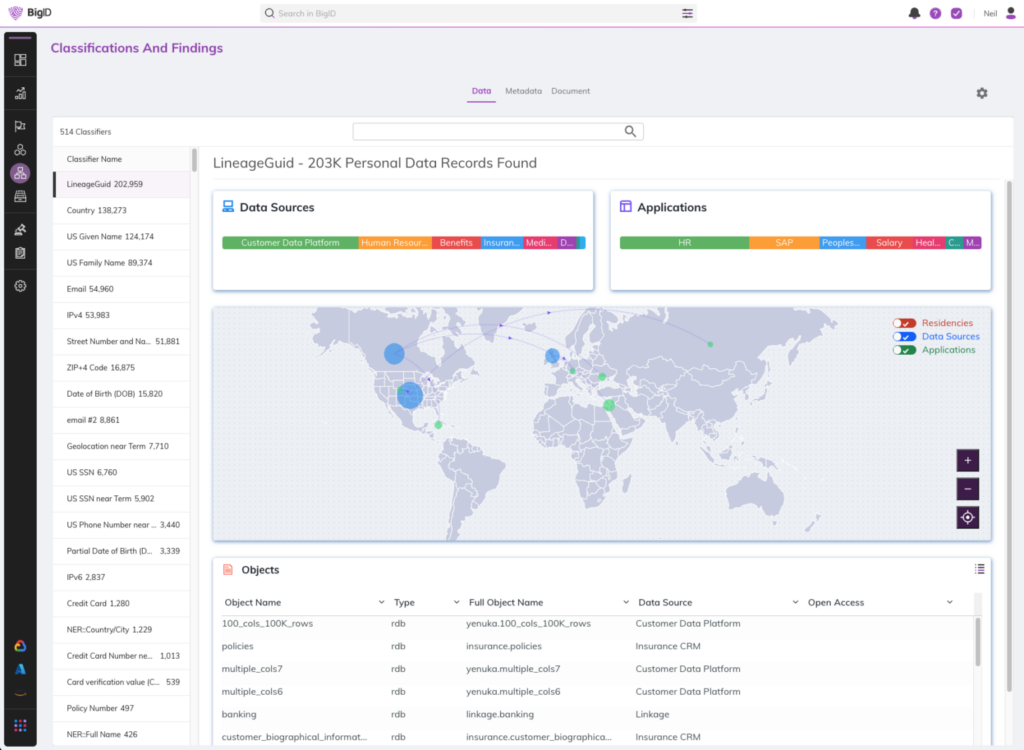

Leverage both traditional and modern classification techniques using NLP and ML to find, classify and categorize all account-related data, including names, codes, dates, and more. Automatically highlight, prioritize, and remediate data at risk.

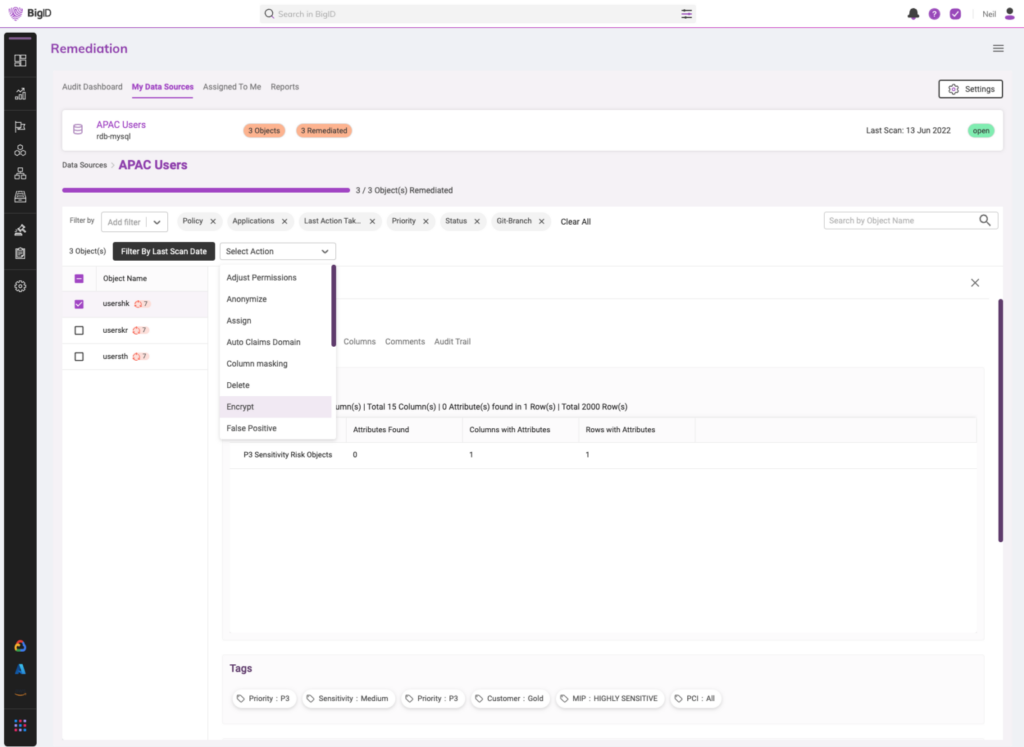

The Data Remediation App enables the right remediation workflows to protect cardholder data. Set policies around specific cardholder data types that require encryption, and then automatically assign the right people and tools to carry out encryption workflows.

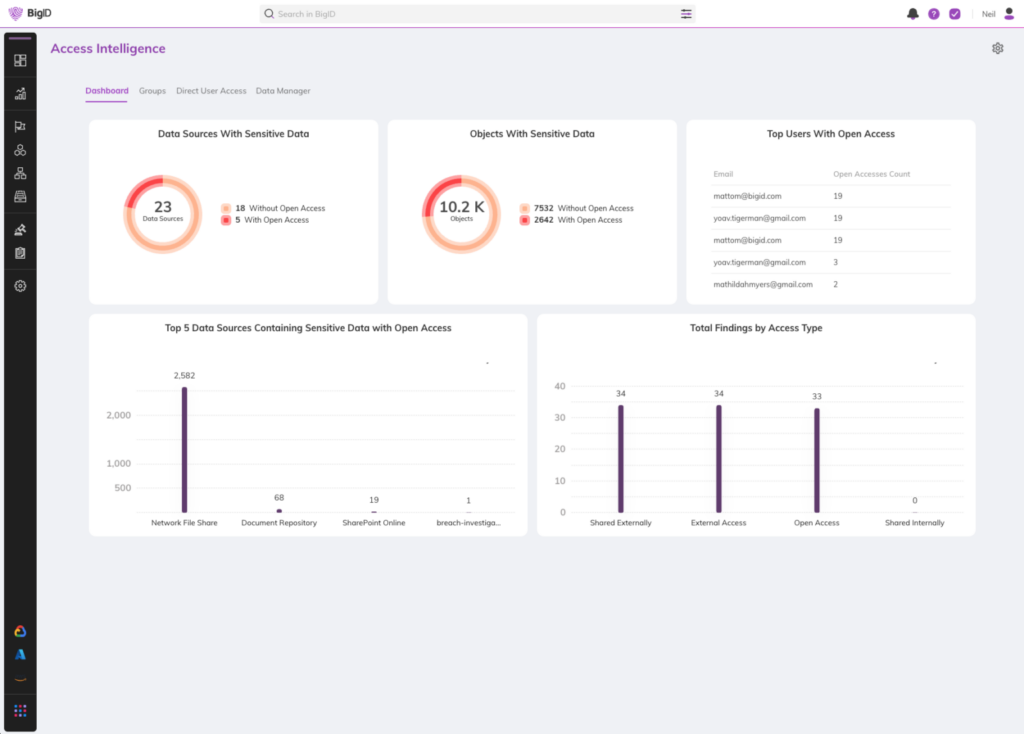

Use the Access Intelligence App and ML-based insight to identify, flag, investigate, and prioritize overexposed cardholder data – then revoke access rights from groups to reduce the risk of data leakage. Automatically identify and classify sensitive cardholder data stored in Snowflake. Natively enforce data access and masking on cardholder data without a proxy.

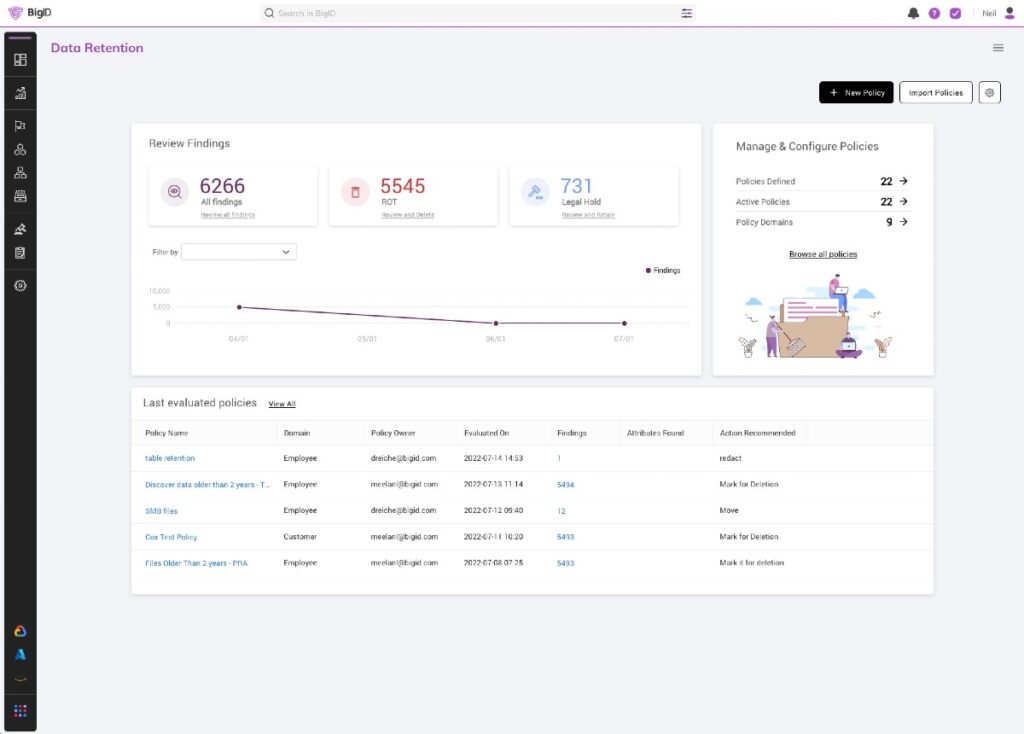

Enforce policies around sensitive payment-related data and kick off remediation workflows with the Data Remediation App. Use the RoPA Data Mapping App to map account data processing and sharing to assess the risk profile for a business process. Use the Data Retention App to detect data retention violations and carry out remediation wherever payment-related data exists.

Enable remediation of high-risk, sensitive, and regulated data.

Policy-driven retention management for all data, everywhere.

Manage records of processing activities for compliance.

Data classification reimagined for the modern data landscape.

Identify and remediate high-risk data access issues, at scale.

Complete data labeling for better protection & enforcement.

Get a custom demo with our data experts in privacy, protection, and perspective – and see BigID in action.