Aplicativo de Remediação de Dados

Possibilitar a remediação de dados de alto risco, sensíveis e regulamentados.

O PCI DSS compreende um conjunto mínimo de requisitos de segurança para organizações, servindo como guia para proteger e assegurar dados sensíveis relacionados a pagamentos em todo o seu ambiente. Ele contém diretrizes detalhadas e melhores práticas para preparar, executar e mensurar o desempenho das avaliações de conformidade com o PCI DSS, auxiliando, consequentemente, no cumprimento das exigências de conformidade.

A BigID ajuda as organizações a atender aos requisitos do PCI DSS usando uma plataforma moderna de inteligência de dados que combina descoberta de dados confidenciais, classificação de última geração e gerenciamento de riscos. Com a BigID, as organizações podem:

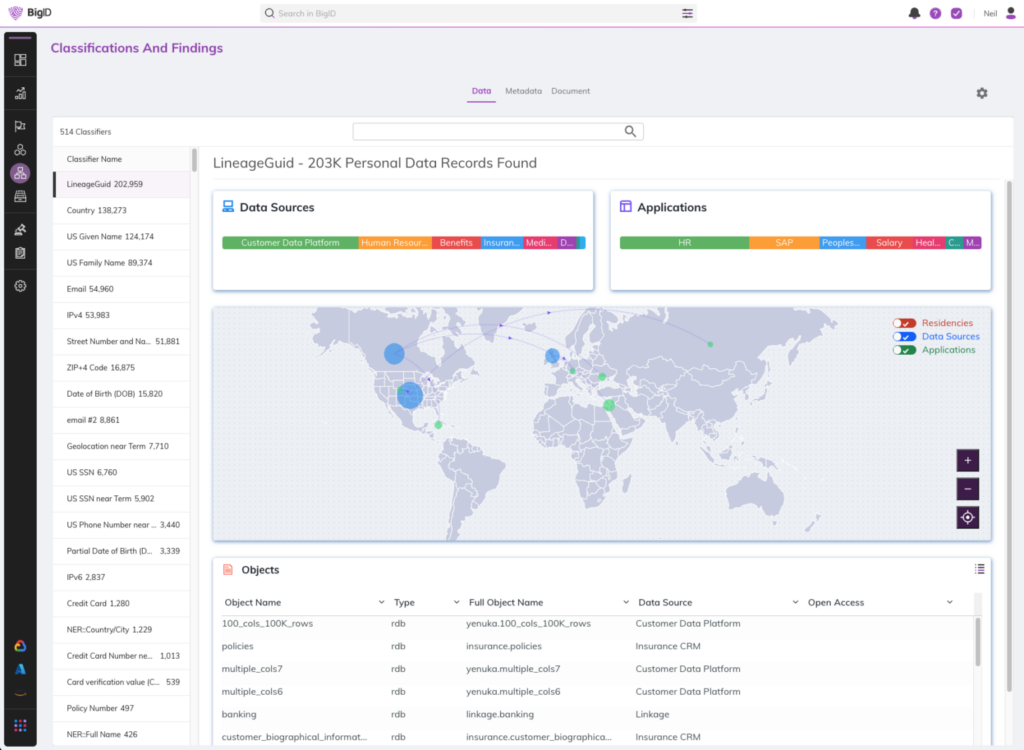

Utilize técnicas de classificação tradicionais e modernas com PNL e ML para encontrar, classificar e categorizar todos os dados relacionados à conta, incluindo nomes, códigos, datas e muito mais. Destaque, priorize e corrija automaticamente os dados em risco.

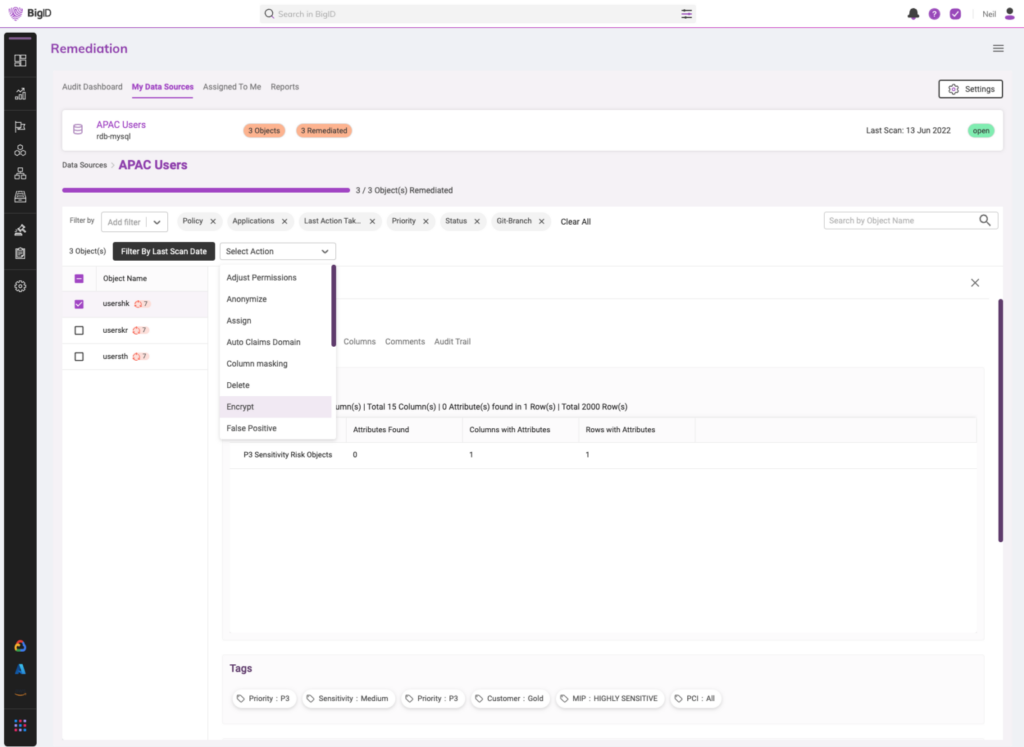

O Aplicativo de Remediação de Dados Permite os fluxos de trabalho de remediação adequados para proteger os dados do titular do cartão. Defina políticas em torno de tipos específicos de dados do titular do cartão que exigem criptografia e, em seguida, atribua automaticamente as pessoas e as ferramentas certas para executar os fluxos de trabalho de criptografia.

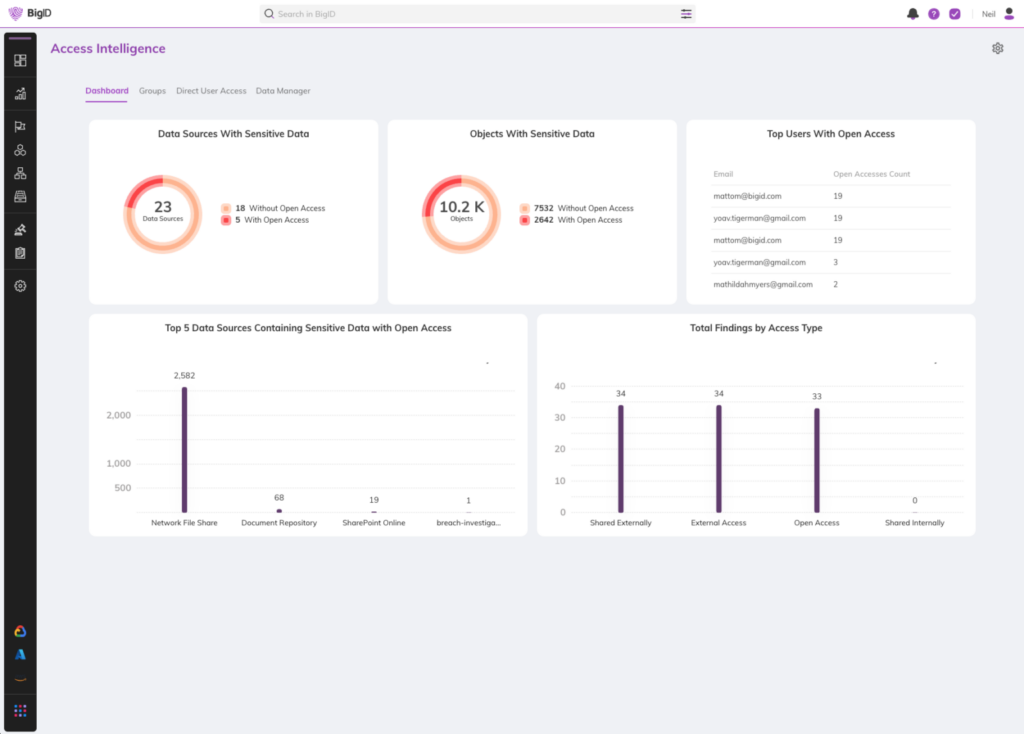

Use o Aplicativo Access Intelligence e insights baseados em aprendizado de máquina para identificar, sinalizar, investigar e priorizar dados de titulares de cartões superexpostos – e, em seguida, revogar direitos de acesso de grupos para reduzir o risco de vazamento de dados. Identifique e classifique automaticamente dados confidenciais de titulares de cartões armazenados no Snowflake. Aplique acesso e mascaramento de dados de titulares de cartões nativamente, sem a necessidade de um proxy.

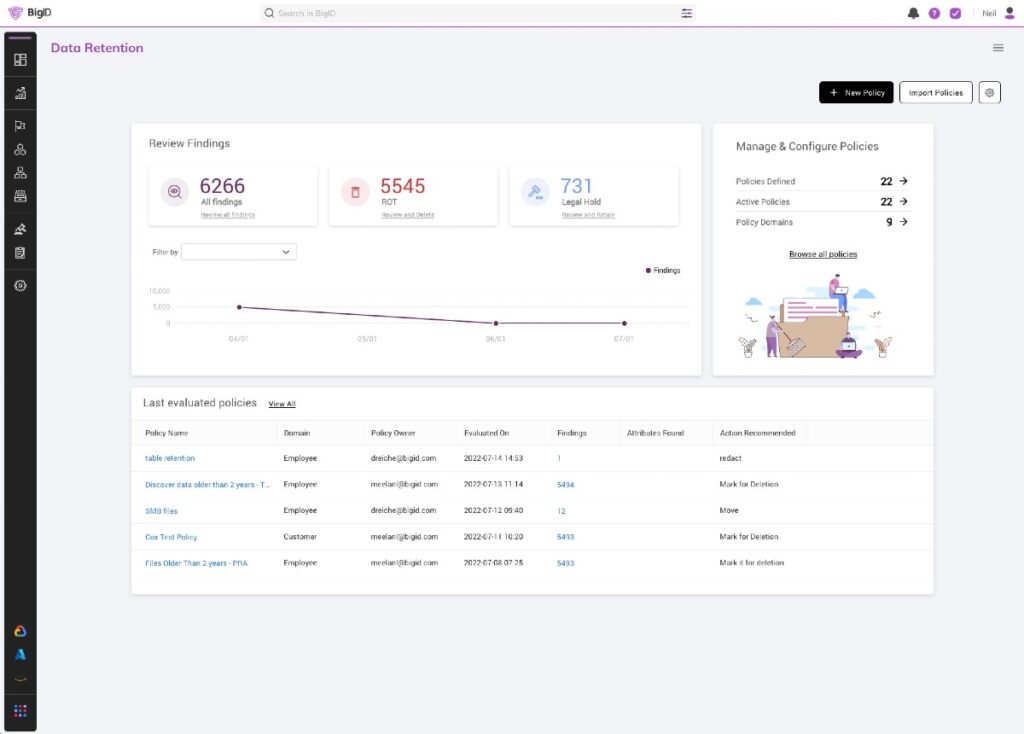

Aplique políticas relacionadas a dados confidenciais de pagamento e inicie fluxos de trabalho de remediação com o aplicativo de remediação de dados. Use o Aplicativo de mapeamento de dados RoPA Mapear o processamento e o compartilhamento de dados de contas para avaliar o perfil de risco de um processo de negócios. Use o Aplicativo de retenção de dados Detectar violações de retenção de dados e realizar correções sempre que existirem dados relacionados a pagamentos.

Possibilitar a remediação de dados de alto risco, sensíveis e regulamentados.

Gestão de retenção orientada por políticas para todos os dados, em qualquer lugar.

Gerenciar registros de atividades de processamento para fins de conformidade.

Classificação de dados reinventada para o cenário de dados moderno.

Identificar e solucionar problemas de acesso a dados de alto risco em larga escala.

Rotulagem completa de dados para melhor proteção e fiscalização.

Agende uma demonstração personalizada com nossos especialistas em dados nas áreas de privacidade, proteção e perspectiva – e veja o BigID em ação.